Welcome to Beating the Odds. Our goal is to create and curate content on investing, strategy, tech, fashion and anything else we find interesting.

Farfetch (ticker: FTCH) is a company I’ve been familiar with for a couple years, but they’ve started to attract increased attention in the capital markets over the past year. Farfetch recently announced a partnership with and investments from Alibaba, Richemont, and Artémis (controlling shareholder of luxury conglomerate Kering).

They serve the retail and luxury fashion industry, but are a tech company at heart. So what exactly do they do? From their website:

FARFETCH Limited is the leading global platform for the luxury fashion industry. Our mission is to be the global platform for luxury fashion, connecting creators, curators and consumers. Founded in 2007 by José Neves for the love of fashion, and launched in 2008, FARFETCH began as an e-commerce marketplace for luxury boutiques around the world. Today the FARFETCH marketplace connects customers in over 190 countries with items from more than 50 countries and nearly 1,300 of the world’s best brands, boutiques and department stores, delivering a truly unique shopping experience and access to the most extensive selection of luxury on a single platform.

FARFETCH's additional businesses include FARFETCH Platform Solutions, which services enterprise clients with e-commerce and technology capabilities; Browns and Stadium Goods, which offer luxury products to consumers; and New Guards, a platform for the development of global fashion brands. FARFETCH also invests in innovations such as its Store of the Future augmented retail solution, and develops key technologies, business solutions, and services for the luxury fashion industry.

Let’s break down each of their business segments.

Farfetch Marketplace

This is their two-sided online marketplace that connects consumers with multi-brand luxury boutiques and individual brands (think Gucci, Burberry, Marni, etc.). Both first-party (Farfetch-owned inventory) and third-party sales take place on Farfetch marketplace. Farfetch enjoys a ~30% take rate on third-party transactions.

A majority of marketplace revenue is from third-party transactions, but first-party transaction revenue is growing faster and steadily catching up. The marketplace is their bread and butter, and accounts for a majority of their revenue. Farfetch reported more than 500,000 new consumers and over 2.5 million active consumers at the end of June 2020.

Boutiques and brands seem to be fans of the model, as Farfetch reported a 100% three-year retention rate for its top 100 direct brand and top 100 boutique partners as of the end of Q2 2020. When they announced Q2 earnings, Farfetch offered 380,000 SKUs from over 3,500 brands and their platform boasted an average order value of $493, down from $600 as of Q2 2019.

Farfetch Platform Solutions

Farfetch Platform Solutions is their suite of white-label solutions for luxury fashion brands and retailers. These solutions are built on the Farfetch platform, providing the same capabilities and scale as the Farfetch Marketplace. Essentially, Farfetch provides a modular package of solutions for brands and boutiques, from specific bundles of products and services to a full end-to-end ecommerce experience.

Farfetch Platform Solutions is built on a fully API-enabled platform and allows for a flexible front-end suite of products including websites, apps or WeChat stores. The back-end infrastructure allows retailers and brands to synchronize their websites with in-store and warehouse inventory, both from mono-brand stores and other suppliers in their distribution network, and facilitate in-store pick-up and customer returns.

From the Farfetch website:

In July 2018, FARFETCH acquired CuriosityChina, a digital and technology business that focuses on amplifying premium and luxury brands across digital platforms in China. The acquisition extends the Platform Solutions offering for the region, and the team are now able to provide plug-and-play access for luxury brands to expand rapidly in China via an integrated platform servicing Chinese consumers via Web, App, WeChat Store and Mini-Programs.

Among solutions on offer, brands will now be able to:

Design and build (with FARFETCH Platform Solutions or on their own) their brand website, have access to omni-channel features and international capabilities, enabling shipping to 190 countries in 12 languages, including China

Launch their brand iOS App, fully integrated with their brand website, with full international support

Operate their WeChat account with CuriosityChina’s unique, enterprise level, CRM capabilities for the Chinese customer – in China, and when Chinese customers are travelling or living abroad

Create full WeChat Stores and state-of-the-art WeChat “Mini-Programs”

Seamlessly integrate with the farfetch.com global marketplace

This acquisition is just one of many pieces of Farfetch’s China strategy. According to Bain, Chinese shoppers represented 33% of the global luxury market in 2018 and their share is steadily increasing, mainly driven by spending from Chinese millennials. Chinese consumers made 27% of their luxury purchases in China in 2018, up from 23% in 2015, and Bain anticipates that this share will increase to 50% by 2025.

Physical Retail

Browns and Stadium Goods are the two main physical sales channels for Farfetch, along with some New Guards Group portfolio brand stores. All were brought under the Farfetch umbrella via acquisitions.

Browns is a multi-brand luxury retailer with 2 locations in London and has become one of the best known and most respected boutiques in the UK. Farfetch also uses its Browns locations to test new technology and features in a physical ecosystem.

Acquired by Farfetch for $250 million in 2018, Stadium Goods is a leading retailer that sells sneakers and clothing, including resale of rare shoes and streetwear. The flagship store is located in SoHo, Manhattan and they recently opened a new retail store and market center in Chicago.

CEO Jose Nevés is bullish on the international opportunity for the sneaker resale market. In 2016 Stadium Goods partnered with Alibaba Group’s Tmall Global platform to begin expanding into China (its second largest market behind the US).

New Guards Group (NGG)

Farfetch acquired NGG in August 2019 for $675 million. The move seemed to be highly misunderstood by Wall Street, as Farfetch stock dropped over 40% to all time lows on the news.

NGG is a fast-growing Italian holding company that provides infrastructure, production and distribution capabilities to its portfolio of highly sought after contemporary brands including Off-White (founded by Virgil Abloh, the Men’s Artistic Director at Louis Vuitton), Heron Preston, Palm Angels and Ambush. They are a leader in discovering, launching and scaling independent labels.

Off-White is regarded as one of the best-selling contemporary brands, especially among millennials and Gen Z. In fact, it topped the rankings of world’s hottest fashion brands as of Q4 2019, as determined by Lyst. From Business of Fashion in August 2019:

Farfetch is betting that, together with New Guards, it can create a flywheel effect to grow "brands of the future" at a faster rate. Farfetch hopes to capture more of the profits of transactions on its marketplace and give its owned labels a boost online and through its network of more than 650 boutiques stores.

“We then take [New Guards brand-building platform] and give these talents the online exposure that they so much need to build the brands of the future,” said Neves. “We think this is an incredible acceleration of our existing strategy.”

For New Guards, Farfetch will not only give it more resources to launch new brands but also a platform to quickly scale its existing portfolio. Its brands currently generate on average of about 95 percent of their revenue through wholesale and franchise mono-brand stores, channels with disadvantageous margins.

The synergies both companies gained from teaming up may still be underappreciated. New York Times (paywall) recently published a good piece on NGG.

How do they make money?

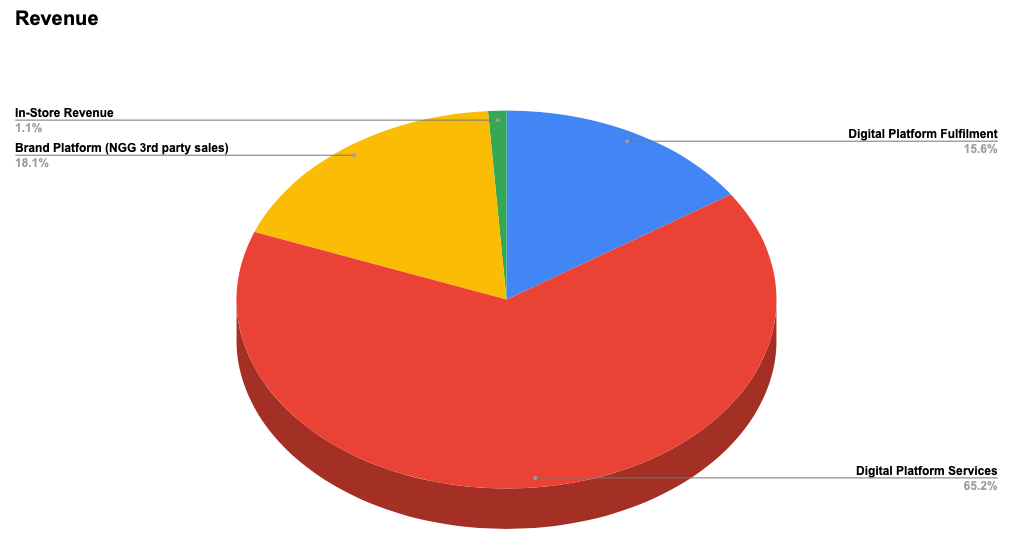

Revenue breakdown as of Q2 2020:

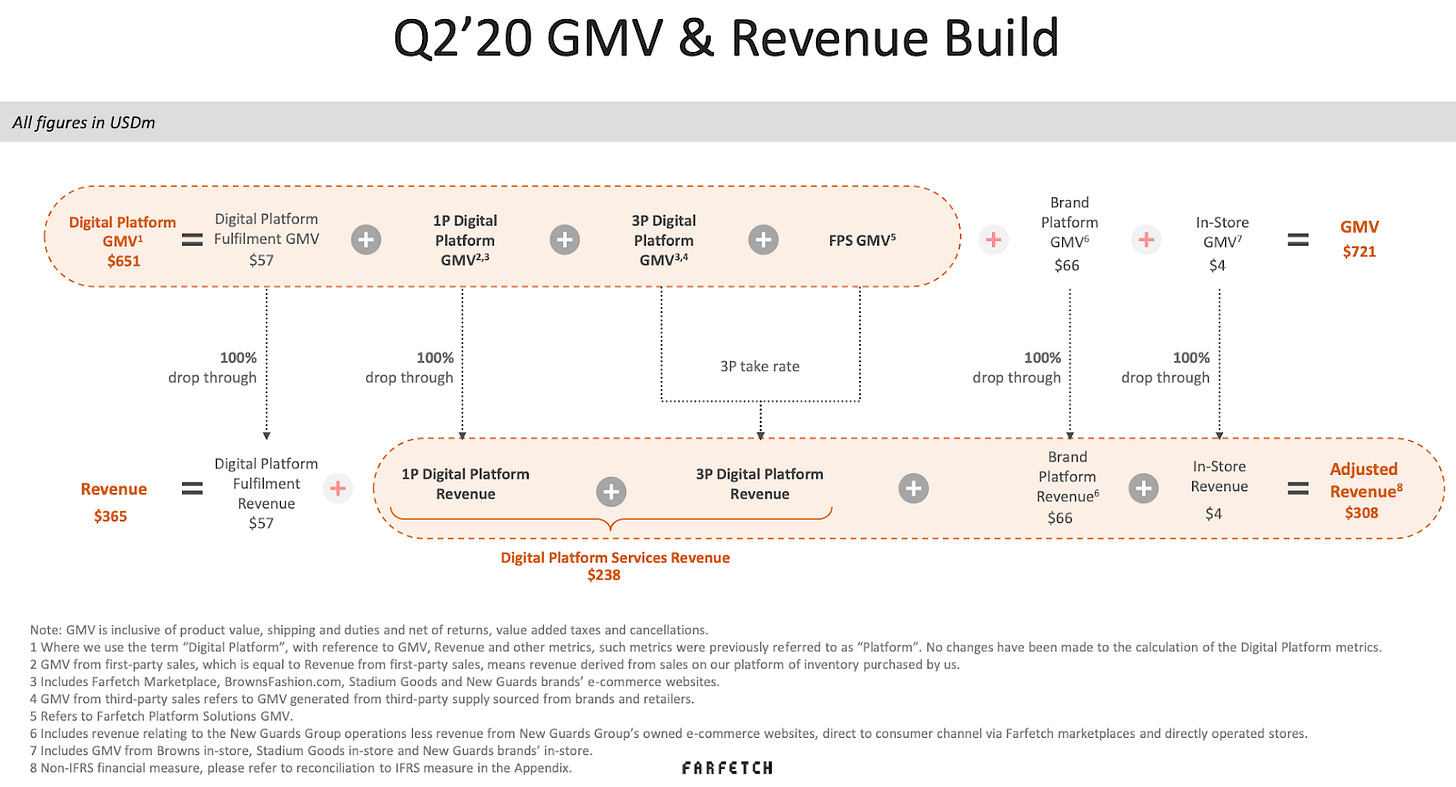

From the Q2 earnings release:

Metrics Definitions

The introduction of the term “Digital Platform” with reference to GMV, Revenue and other metrics is intended to distinguish between activities that occurred through our owned and operated e-commerce platforms (e.g. Farfetch.com, BrownsFashion.com, off---white.com) and the Brand Platform operations of New Guards, where GMV and Revenue are derived from our transactions with independent third party retailers or wholesalers.

It’s important to note that Brand Platform revenue solely consists of wholesaling NGG merchandise to independent third-parties. NGG first-party transactions are captured within Digital Platform Services and In-Store. Overall, in-store revenue decreased to $4M from ~$10M in Q4 2019 due to travel restrictions and a drop in traffic related to COVID-19. I expect these sales to trend higher over future quarters, depending on developments related to the coronavirus.

As of August 13, 2020, Farfetch anticipated the following for Q3 2020:

Digital Platform GMV of $588 million to $609 million, representing growth of 40% to 45% year-over-year

Brand Platform GMV of $90 million to $95 million

Adjusted EBITDA of $(20) million to $(25) million

Farfetch announced Q3’20 earnings on November 12th. Here is my update on their ER and partnership with Alibaba.

Thanks for reading! If you found this helpful, give it a heart up above or at the bottom to help others find it, or share it with your friends. If you’re not a subscriber, you can subscribe below to be notified of future posts.

Additional resources:

9/21/18:

Theta Equity Partners: Farfetch IPO: Strong Unit Economics Support Its Projected Valuation

6/20/20:

Left Brain Investment Research: Farfetch: Post-Pandemic Upside

7/2/20:

Business of Fashion interview w/ CEO Jose Nevés

9/10/20:

9/16/20:

KeyBanc Capital Markets’ Future of Technology Series - Video Interview w/ Farfetch CFO Elliot Jordan

10/29/20:

Gulf Business: Farfetch founder Jose Nevés on the exponential growth of luxury fashion e-commerce

11/6/20:

Management’s presentation regarding the recent announcement with Alibaba, Richemont, and Artémis.

Disclosure: None of this is investment advice. I own FTCH shares.

Wow great work, mate!