Weekly Update: 12/20/20

Moderna's vaccine, Microsoft to develop its own chips, streaming wars, AWS Graviton gains share, Farfetch wants to be fashion's Netflix, Facebook's future, interviews with Cloudflare & Octahedron

Welcome to Beating the Odds. Our goal is to create and curate content on investing, strategy, tech, fashion and anything else we find interesting.

🔍 Tickers mentioned: PFE, MRNA, MSFT, DIS, AMZN, INTC, FTCH, FB, NKE, ROKU, NET, TWLO, CRM, ZM, OKTA, SNOW, CRWD, ESTC, TGT

⚡️ Quick links

💉 STAT News — A side-by-side comparison of the Pfizer/BioNTech and Moderna vaccines

🖥 Engadget — Microsoft is reportedly developing its own ARM-based chips for Surface PCs

📸 The Times UK — A year like no other: 2020 in pictures

👟 WSJ — StockX Snags $2.8 Billion Valuation in Latest Funding Round

🧠 Colossus — Introducing Colossus. “Our goal is to become the destination to learn about business building and investing. Our aperture is wide. We will cover everything from network effects to Nintendo, Data Dog to Domino’s Pizza, and cohort retention to the cash conversion cycle.” As usual, incredible work from Patrick O’Shaughnessy and team—excited to see how this project evolves

📺 The Economist — Disney and Warner make big bets on the small screen. “The plans for Disney+ imply that by 2024 streaming will be the company’s single largest business by revenues.” If they pull it off, this will go down as one of the most impressive digital transformations of any legacy business model

📊 Charts of the week

Calling all growth investors

Amazon Web Services

The chart breaks out North American instances of CPU market share across AWS. One of the most telling conclusions is related to the growing Graviton share. Graviton is AWS’s own custom-designed Arm server processor, which promises up to 40% better performance from comparable x86-based instances for 20% less.

This thread does a much better job of explaining the context and details than I can, but it’s important to understand this as another step in big tech’s march towards custom silicon and vertical integration:

This post from AnandTech is also highly informative.

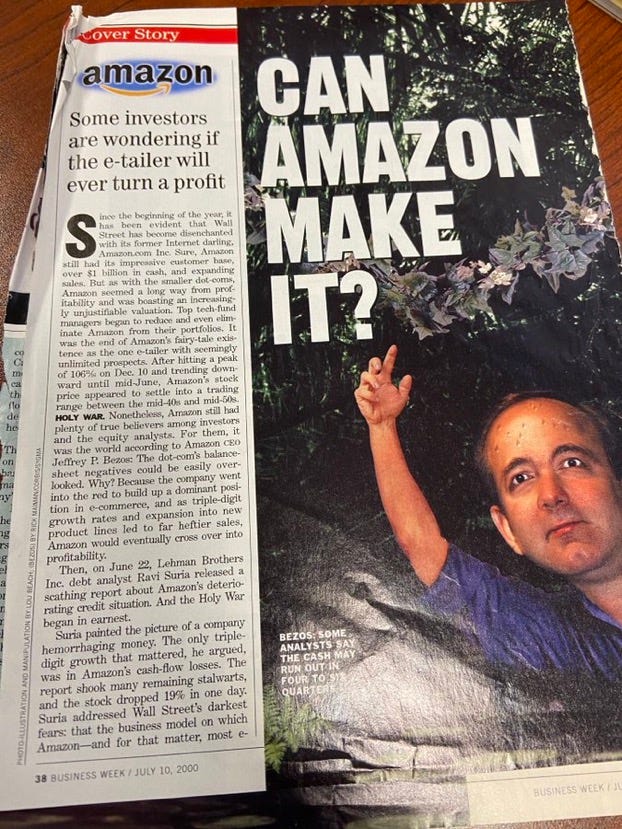

Speaking of Amazon, Michael Mauboussin dug this up from the archives:

20 years and $187 billion in net worth later…

📚 Good reads

GQ — Farfetch Wants to Be the Netflix of Fashion

Not Boring — Everybody Hates Facebook. Packy makes the bull case for FB while expressing how we all feel. Favorite quote: “You hate Facebook. I hate Facebook. Regulators hate Facebook. The only person who likes Facebook is that guy you went to high school with who posts Q Anon content and still wishes you happy birthday every year.”

Bloomberg — Facebook Sees WhatsApp As Its Future, Antitrust Suit or Not. Another solid piece on the future of Facebook. From the article:

Eventually, Facebook believes, it can control the entire exchange between a brand and its customer, starting with an ad on Facebook or Instagram and leading to an interaction or product sale on WhatsApp or Messenger. “Instagram and Facebook are the storefront,” says WhatsApp Chief Operating Officer Matt Idema. “WhatsApp is the cash register.”

Ali Hamed at CrossStack — The Amazon Third Party Seller Ecosystem Might be the Most Important Thing Since the iOS App Store

Business of Fashion — The Radical Strategy That Drove Nike’s Pandemic Success

Financial Times — Cult figure of investing one of few to grasp early promise of internet stocks. This article is from early August, but I wanted to share here as Nick Sleep’s highly prized and hard to find investment letters recently resurfaced on FinTwit (consider downloading in case they’re taken down)

Morgan Housel at Collaborative Fund — Last Man Standing

WSJ — Roku Torments Entertainment Giants in Quest to Dominate Streaming. Roku and Amazon continue to lead the streaming device/software space:

Brad Smith, President of Microsoft — A moment of reckoning: the need for a strong and global cybersecurity response

This is not “espionage as usual,” even in the digital age. Instead, it represents an act of recklessness that created a serious technological vulnerability for the United States and the world. In effect, this is not just an attack on specific targets, but on the trust and reliability of the world’s critical infrastructure in order to advance one nation’s intelligence agency. While the most recent attack appears to reflect a particular focus on the United States and many other democracies, it also provides a powerful reminder that people in virtually every country are at risk and need protection irrespective of the governments they live under.

Americana: A 400-Year History of American Capitalism. Only five chapters in, but already one of the most interesting books I’ve ever read. Wouldn’t be surprised if we see it as a Netflix series someday. Find out more here:

🎧 Press play

Invest Like the Best — Michelle Zatlyn - Protecting the Internet - [Founder’s Field Guide, EP.11]

Michelle is the co-founder and COO of Cloudflare, a now $25 billion dollar business which she helped take public last year. Cloudflare helps businesses make their websites faster and more secure, and over 25 million websites are running Cloudflare today. In our conversation, we discuss the catalyst for starting Cloudflare, explore the layers of the internet and the future of distributed storage and computing power, and discuss how and why Cloudflare operates its network across 200 cities globally.

“We stop 72 billion cyberattacks daily” (Michelle). Cloudflare is the immune system for the Internet. MIT Technology Review wrote a good piece on the company earlier this year.

Peep the public co. returns after appearing on the Invest Like the Best podcast (these are actually even higher as of time of writing):

Panic with Friends — Ram Parameswaran of Octahedron Capital On Why Investing should be Simple, Not Easy (EP.125)

I had the pleasure of having Octahedron Capital founder Ram Parameswaran on this episode of Panic. His firm Octahedron is a crossover fund that invests in the internet economy. Previously, Ram was a partner at the multi-billion dollar firm Altimeter Capital, focusing on public and private tech investments. He also has some big names in his past investments, including a pre-IPO Uber, Google and TikTok parent Bytedance. Ram has been inside the beast and is now applying it to his own markets. He’s a smart guy and public investor who knows a lot about a lot. In this episode, Ram and I discussed growth, the culture of Silicon Valley, tech, his work at Octahedron Capital, SPACs, trends in the public & private markets, crossover funds, global investing and more.

Learned a lot from this one. Octahedron’s Q3’20 insights deck is also great and worth checking out. Money quote from Howard towards the end of the episode: “Twitter and Stocktwits—follow smart people. Don’t have to reinvent the wheel. Guys laying cupcakes on the road for you to eat.” Amen.

📺 Videos of the week

Beth Kindig — Motley Fool Interview

In this video, Beth Kindig speaks with Tim Beyers and Brian Feroldi of The Motley Fool on growth stocks including upcoming stocks to watch in 2021.

Anyone interested in tech or growth investing will enjoy this one. Cloud, big tech, edge computing, Twilio vs Salesforce, valuations—is tech in a bubble?, Zoom, and Beth's favorite stock picks for 2021 (interview timestamps here).

Beth also reviewed Q3 earnings reports for Zoom, Okta, Snowflake, Crowdstrike and Elastic in this Forbes piece (highly recommend her free newsletter).

Gavin Baker on Investing in Omnichannel Retailers

Gavin Baker gave a presentation focused on investing in Omnichannel Retail in November 2020 to help raise money for the Sohn Hearts and Minds Foundation in Australia. This presentation builds on Gavin Baker's Medium article, "Why Category Leading Brick and Mortar Retailers are the Biggest Long Term Covid Beneficiaries."

I thought this was a highly compelling stock pitch for Target (ticker: TGT). Gavin’s article (linked above) is also worth a look.

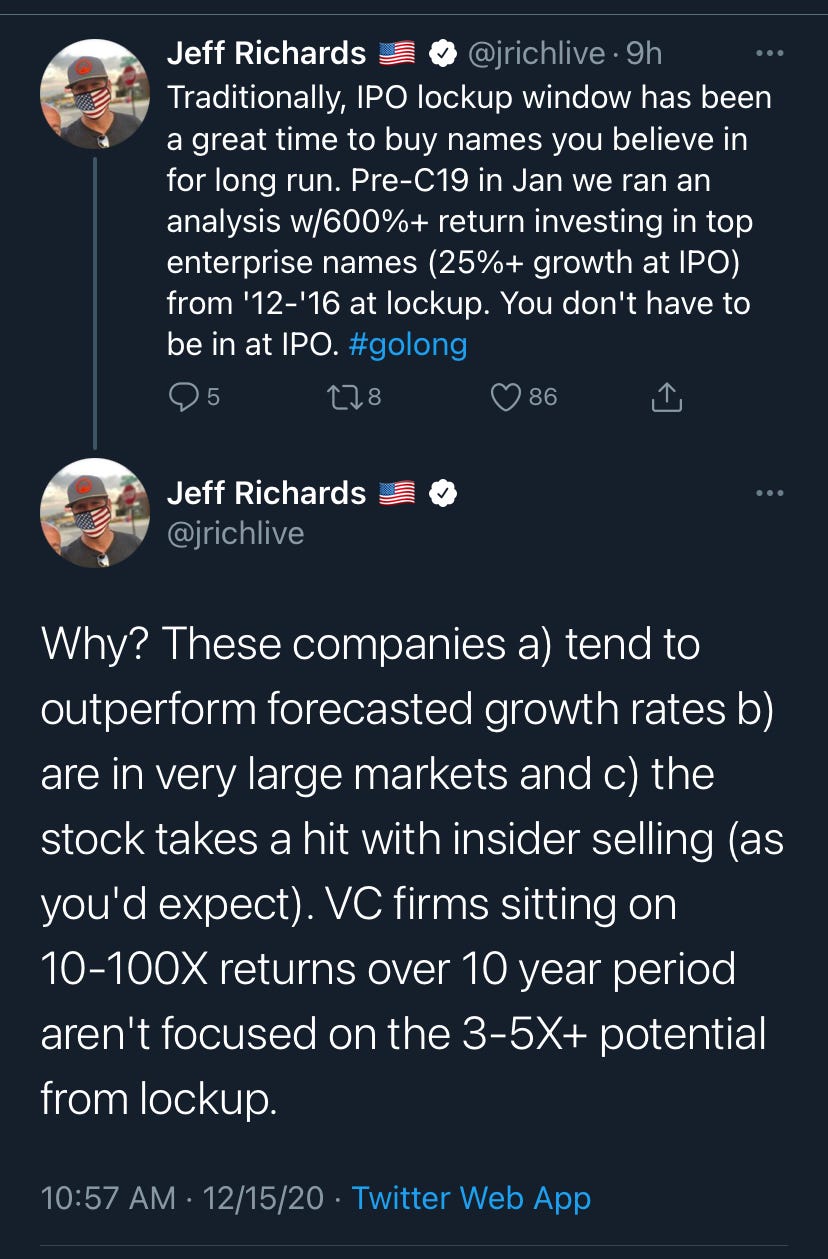

Pro tip from Jeff Richards, Managing Partner at GGV Capital. Get your shopping list and cash ready for the next 3-6 months…

Disclosure: None of this is investment advice. I own MSFT, AMZN, FTCH, FB, ROKU, NET, TWLO, CRM, OKTA, CRWD and ESTC shares.

Thanks for reading! If you liked this post, give it a heart up above or at the bottom to help others find it, or share it with your friends. Questions, comments and feedback are always appreciated.

If you’re not a subscriber, you can subscribe below to be notified of future posts.